Washington Just Put Silver on the Critical List1 — and the Market is Waking Up Fast

It’s happening quietly… but it’s happening fast. Silver is now at all-time highs–signalling a historic breakout years in the making.2 And for the first time in history, Washington has officially labeled it a “Critical Mineral.”

That one move changes everything. Because silver isn’t just another precious metal.

It’s essential — powering chips, sensors, solar panels, EVs, data centers and even advanced defense systems.3 And now, it’s getting scarce.

A record supply shortfall is projected for 2026.

Meanwhile, sovereign wealth funds and billionaire investors are already positioning — funneling millions into silver-backed ETFs and early-stage producers.

This is how every major metals bull market begins.

When technology demand collides with monetary demand, it doesn’t just lift prices — it launches supercycles.

That’s why names like Core Silver Corp. (CSE: CC | OTC: CCOOF) are stepping hard on the accelerator right now.

With drilling underway and fresh funding in place, Core Silver is pressing its advantage just as the entire market begins to reprice silver higher.

The setup is rare. The timing even rarer.

And it’s only just getting started.

National Security Spending Spree Targets Silver Surge

Silver is getting tight worldwide, with shortages piling up year after year.

But the U.S. is in one of the most precarious positions of all because America is almost entirely dependent on imports for silver.

Nearly 70% of what we use comes from abroad.4

Domestic production hasn’t covered American demand in decades.

Last year the U.S. mined about 1,000 metric tons of silver but consumed more than double that.

The deficit is persistent, structural, and widening.

And this gap extends beyond silver as an investment or its use in today’s electronics, it’s critical for national defense too.

That could be the biggest catalyst yet for silver.

You see, Washington has launched a multi-billion-dollar spending spree to keep its armories of the most advanced weapons well stocked.

The ultra-sensitive electronics that have become essential in cruise missiles, javelins, and drones all require silver.

Silver is essential to radar systems that power modern fighter jets, navy vessels, and virtually everything that flies.5

Even soldiers on the ground use radios that depend on silver’s unmatched conductivity.

Stack all that up, and defense is quietly becoming one of the fastest-growing sources of silver demand.

The Jerusalem Post reports, “Recent analysis suggests that military usage of silver may be substantially greater than any other industry category, including electronics, solar panels, and investment demand combined.”6

That’s big.

But it could get even bigger when you add in the domestic and global undersupply, and every new round of defense spending tightens the screws on silver supply even more.

And it’s going to take a significant influx of capital to realign supply with demand.

Domestic silver was already in chronic deficit where the U.S. has consumed more than it produced for decades.7

That’s a big reason silver prices are surging and why investors are piling in.

A Simple Fact Turns Silver’s Surge Into an All-Out Stampede

Silver isn’t just rising — it’s breaking out. And the reason is simple.

Silver is different.

It’s a true dual-use metal — part precious, part power source.

It acts like money… and it powers modern life.

For centuries, silver was real currency. Romans, Greeks, and Spanish fleets sailed across oceans to find it. That story didn’t end — it just evolved.

Mining replaced minting. ETFs replaced treasure ships. And now, investors are rediscovering silver’s monetary firepower.

Kitco, one of the world’s top bullion dealers, reports: “Silver investment skyrocketed in 2025 — driven by strong ETF inflows.”9

That’s the first side of silver’s identity — the monetary metal. The second is even bigger.

Silver is also the workhorse of modern technology. It’s the best conductor of electricity on Earth.10 That makes it indispensable in chips, sensors, solar panels, EVs, data centers — and even the advanced defense systems that protect them.

From satellites to smart weapons, silver is built into the backbone of modern security and communications.

Washington just confirmed it, officially adding silver to the U.S. “Critical Minerals” list11 — recognizing its essential role in national technology and defense.

That priority status means faster approvals, fewer bottlenecks, and greater focus on domestic production.

Put simply, silver now has unstoppable demand engines firing at once: monetary, industrial and defense.

The Silver Supercycle Starts Now

All sides of silver’s “multi use” story are surging together — something markets rarely see.

Monetary demand is climbing fast as investors look for a hedge after gold’s big run. Silver is cheaper, more volatile, and historically quick to catch up.

Industrial demand is hitting records. Every new device — every chip, sensor, and solar cell — pulls more silver off the market.

And defense demand is quietly massive. Analysts have found military applications may now consume more silver than any other single category12 — metal that never returns to circulation.

That’s multiple demand waves converging. Historically, one is enough to start a bull market. But three is how a supercycle begins.

That’s why companies like Core Silver Corp. (CSE: CC | OTC: CCOOF) are pressing forward now — expanding exploration and development while the window is still open.

If this cycle unfolds as expected, new ounces in the right districts could be worth many times more than they are today.

And demand is only half the story.

The other half — supply — may be the most explosive catalyst of all.

Silver Supply Stall Puts “Squeeze” In Play

Demand is surging. Supply is not. Production has been flat for years. Even with steady increases in demand, it would struggle.

With demand rising as fast as it is, production will not catch up for years. But flat supply cannot absorb sharp spikes from electronics or waves of monetary buying. Not all at once.

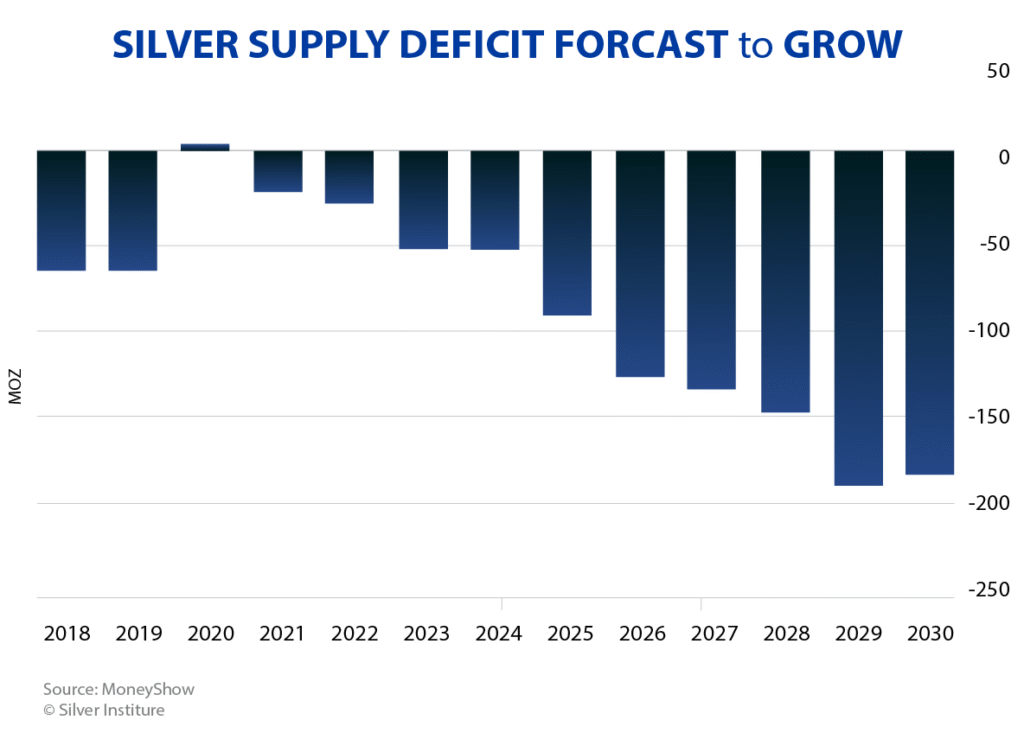

Silver is barreling toward a record shortfall in 2026.13

"Global demand for silver has created the biggest deficit in decades.” And the Silver Institute expects the shortfall to keep growing into 2030"

Reuters

The proof is in the market. Silver is outrunning gold, copper, and palladium. No small feat given their own historic runs.15

Now comes the second wave.

New technologies are rolling out everywhere. Many of them are silver-hungry. Chips. Sensors. Solar Power. Electronics. Antennas.

That’s why names like Core Silver Corp. (CSE: CC | OTC: CCOOF) could be set for a major surge.

The scale of these demand surges may still be a bit underestimated. The setup is bigger than most models capture.

Here is just one example.

This Tiny Tech Outsells iPhone 50 to 1 – And it’s Sparking a New Silver Boom16

Modern tech runs on silver. As devices shrink and computing power grows, engineers need materials that are fast, efficient, and ultra-reliable in tight spaces.17

Silver wins on all fronts. That’s why electronics are quickly becoming the #1 source of silver demand worldwide – straining a market already in deep deficit.

And now, one device is leading the surge.

It’s not a smartphone.

It’s not a chip.

It’s a RFID tag

A paper-thin chip and antenna combo used to track everything from warehouse goods to retail merchandise, and if you carry a debit or credit card you are carrying a RFID most likely.

There are already 40 billion of them in circulation. And by 2028, that number is expected to nearly triple – to 115 billion.18

That’s over 50x more than the number of iPhones sold globally each year.19

What does this have to do with silver? Nearly every RFID tag contains a tiny amount of it – just 5 milligrams. That may not sound like much – until you multiply it by 115 billion.

The result? Nearly 20 million ounces of silver.

That’s more than the annual output of the world’s second-largest silver mine. All quietly funneled into a single layer of tech most people never think about.

And going into a silver market that’s already deep in deficit, it’s a huge drain.

And RFID is just one source of growing silver demand.

For investors who understand what’s happening, that spells opportunity – and possibly even urgency. Because once this silver wave crests, it might be too late to catch.

Silver Surge: A Global Story in Motion

Silver’s breakout isn’t a local story — it’s a worldwide phenomenon driven by powerful new sources of demand.

From renewable energy to next-generation vehicles and AI infrastructure, silver has become the essential metal of the global economy.

Silver’s unmatched conductivity and reflectivity make it irreplaceable in solar technology. Every photovoltaic cells depend on it.

Across Asia, Europe, and the Middle East, solar installations are soaring — led by massive new capacity in China, which is adding energy output equal to hundreds of nuclear reactors.

And every one of those panels needs silver.

Each solar panel uses roughly 20 grams of silver,22 and multiplied by millions of new panels, the totals are staggering. In 2024, solar alone consumed about 200 million ounces of silver — more than 17% of global supply.

And with the global transition to renewables accelerating, that figure is still climbing fast.

This relentless buildout is a major driver behind silver’s tightening supply — and a key reason prices are surging to new highs.

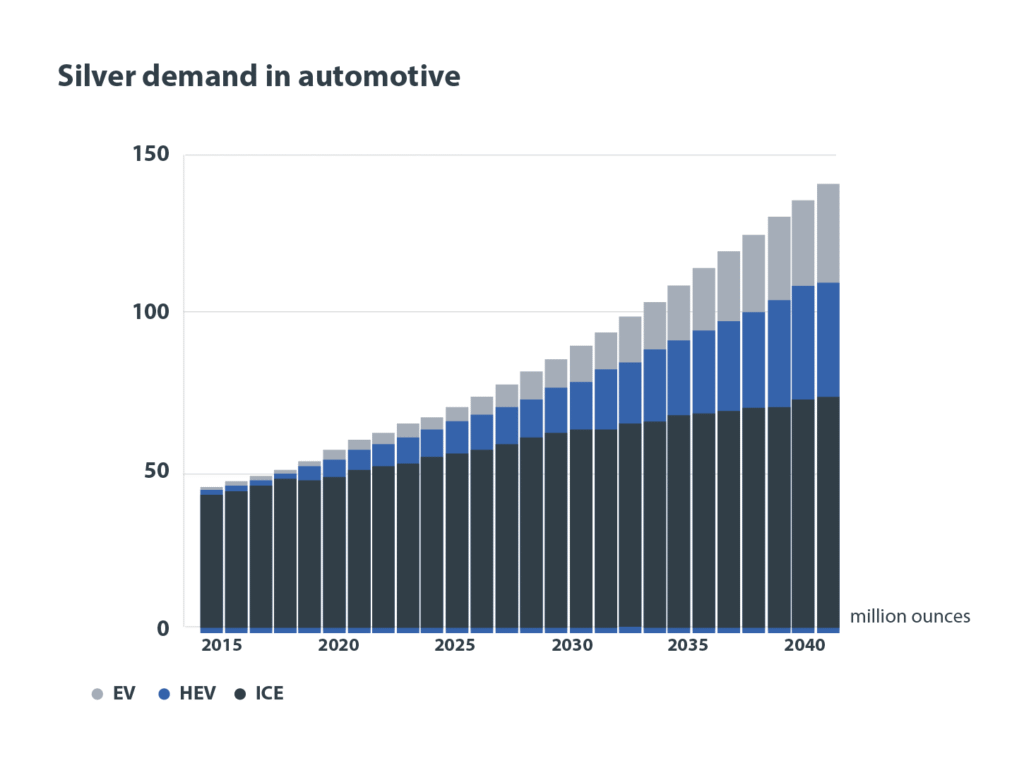

EVs Add Even More Fuel to the Fire

At the same time, the worldwide shift to electric vehicles continues at full speed.

EV sales hit around 17 million in 2024, tracked well above 20 million in 2025, and expected to climb higher still into 2026.23

Every EV is a silver-intensive machine. Between inverters, chargers, relays, and sensors, each vehicle uses 25–50 grams of silver24 — and that number keeps rising as onboard electronics become more advanced.

This surge in production is propelling silver use in the automotive sector to its fastest growth rate in years.

From solar farms to smart cars, the world is wiring itself with silver — and the metal that once symbolized wealth is now the foundation of the new industrial age.

It’s also why companies like Core Silver Corp. (CSE: CC | OTC: CCOOF) are positioning aggressively right now.

Because there’s more to this setup than just demand and supply – there’s also price.

Silver Still Looks Cheap – Even After the Breakout

Even after pushing to new all-time highs, silver remains dramatically undervalued compared to gold and other critical metals.26

Earlier we touched on how silver is a dual-use metal. It powers modern technology – but it also plays a monetary role that gold alone has dominated in recent years.

It’s that monetary side that shows just how undervalued silver really is right now. For centuries, gold and silver have moved in lockstep. They rise and fall together over time.

But today, after gold’s historic breakout and silver still “catching up,” that connection has been stretched to an extreme.

Many analysts don’t expect it to last – and that’s why silver may have far more upside potential than gold.

The Gold-to-Silver Ratio – A Simple Measure of Silver’s Value

The key way to compare the two monetary metals is through the gold-to-silver ratio.

When the ratio is low, silver is expensive relative to gold. When the ratio is high, silver is cheap. At the peak of the last silver mania in 1980, the ratio dropped to about 15:1 – meaning one ounce of gold bought just 15 ounces of silver.

Today it’s the opposite.

With golds recent break through $4,400 and silver around $75, the ratio sits close to 58:1.

That’s one of the highest levels in modern history, which makes silver deeply undervalued compared to gold.

How undervalued?

If gold stayed flat at $4,400 and silver simply reverted to the historical 15:1 ratio…silver would trade around $293 per ounce.

That is more than 4x higher than current levels.

The Junior Advantage – Why the Small Names Can Move Fastest

When silver moves, it’s the junior explorers that often move first – and move the most.

They’re smaller, more nimble, and more directly exposed to price swings. A new discovery or drill result can multiply valuations quickly in a rising market.

This may be the most compelling case for silver companies like Core Silver (CSE: CC | OTC: CCOOF).

Its the explorers and developers sitting on large, silver-rich land positions that offer true leverage to a rising silver price.28

And that’s exactly why Core Silver Corp. (CSE: CC | OTC: CCOOF) is showing up on investor radars – among those who see the bigger story unfolding in silver, not just the daily price swings.

In every silver bull market, it’s the early-stage names — the ones expanding discoveries and drilling new ounces — that can deliver the fastest and most dramatic gains.

When capital flows into mining, explorers and developers can see gains multiplied many times over.

That’s why now is the time to be watching . And that’s why big-money investors have already taken notice.

They backed Core Silver with a direct investment over C$6.0 million (about US$4.3 million) – giving the company the capital to move aggressively.29

With that funding in place, Core Silver (CSE: CC | OTC: CCOOF) has laid out a clear plan.

Core Silver Ramps Up “District Scale” Exploration And Development Efforts

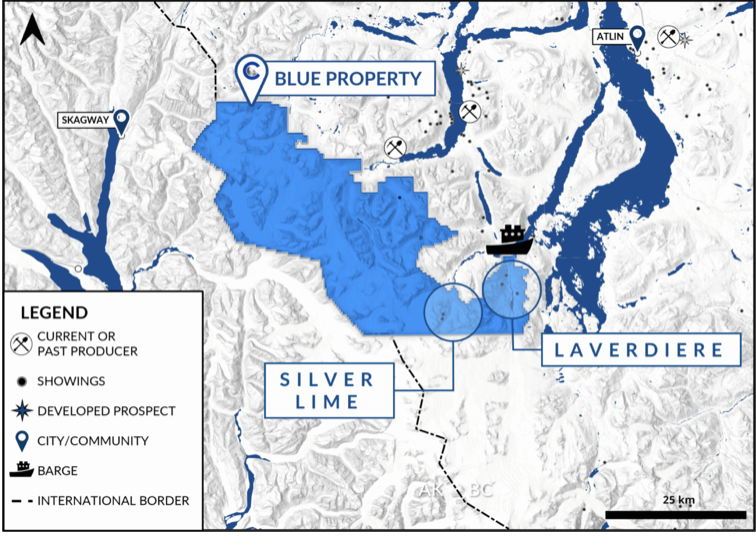

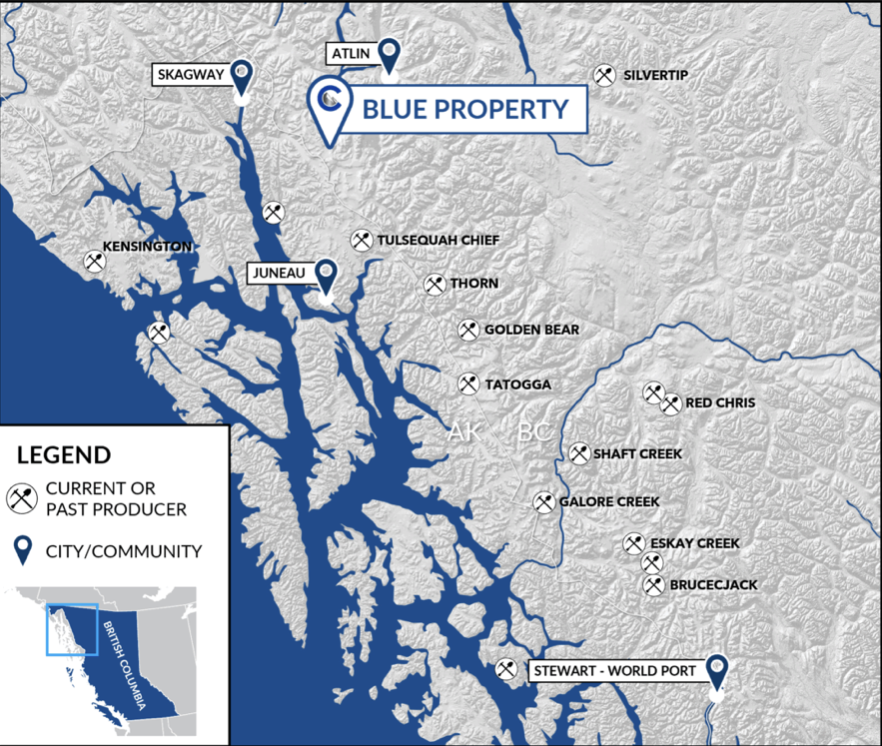

Core Silver’s flagship Blue Project in Atlin, British Columbia, is a true district-scale opportunity — spanning 114,000 hectares on the prolific Stikine Terrane.30

The project offers all the right advantages: excellent infrastructure, year-round access, and proximity to services — just minutes from the Atlin airstrip.

Since 2021, Core Silver has been advancing Blue step by step — with mapping, sampling, and drilling that continue to reveal stronger results and expanding mineralization.

Early momentum is building. Initial drilling has already intersected significant silver zones within a broad, 30-kilometre mineralized corridor containing four distinct centers of mineralization.

Blue sits on the Llewellyn Fault Zone (LFZ) — a deep regional structure known for hosting large mineral systems. Here, intrusive rocks cut through thick carbonates, creating a stacked system with:

- A porphyry engine at depth,

- Copper-rich skarns in the surrounding halo, and

- Silver-dominant CRD (carbonate replacement) bodies extending outward.

It’s the same geological model that built several of northern B.C.’s most productive mining districts.

Atlin has supported mining since the 1898 gold rush, yet the southern Atlin Lake area — where Blue is located — has seen little modern CRD-porphyry exploration. That gap is Core Silver’s opportunity.

Silver Lime: A Growing Discovery Zone

At Silver Lime, systematic work has outlined a 10-square-kilometre mineralized footprint covering the full porphyry-to-epithermal system.

Silver mineralization appears consistently at strong grades over meaningful widths — with intervals hitting bonanza grades at surface and in drill core.

Other metals — copper, zinc, lead, molybdenum, and gold — provide additional value streams, but silver remains the headline.

The system is open in all directions and expanding.

Laverdiere Zone: Tracing the Source

Drilling and mapping at Laverdiere have traced mineralization back toward a porphyry core along the LFZ.

Skarns and veins carrying silver and copper extend for more than a kilometre of strike, with plenty of room to grow both laterally and vertically.

For 2026, Core Silver is focusing on the Valley Zone, where tightly spaced veins and fractures converge around a faulted core — a high-priority target for expansion drilling.

The plan:

- Advance Laverdiere, targeting porphyry and skarn mineralization at depth.

- Expand Silver Lime, drilling multiple centers in parallel.

- Deliver steady updates as meters build and results confirm continuity and scale.

The Blue Project brings together size, access, and the right rocks — all in one of the world’s safest mining jurisdictions.

Early work is already delivering what the market wants to see:

persistent, high-grade, silver-rich mineralization inside a system big enough to matter.

This is the time to watch Core Silver Corp. (CSE: CC | OTC: CCOOF) — before a 30-kilometre trend moves from potential to proof

7 Reasons to Consider Core Silver Corp. (CSE: CC | OTC: CCOOF) Immediately

1) Exploding Silver Shortfall Dead Ahead

A record supply shortfall is projected for 2026. Tight supply is colliding with relentless demand from electronics, defense, and tech. That’s the perfect setup for higher prices — and a potential global silver squeeze.

2) AI Needs Silver to Run

Silver is the quiet workhorse inside chips, servers, data centers, satellites, and EVs. As AI scales and power density rises, silver demand climbs. Supply doesn’t.

3) RFID Is Exploding

These tiny tags are 50x more common than iPhones and taking over logistics and retail. Shipments are surging from 40 billion units to 115 billion by 2026. Each tag uses silver in its antenna — small grams multiplied by billions of units adds up fast.

4) Solar Is Another “Hidden” Driver

Solar panels accounted for about 200 million ounces of silver demand last year, with each panel using roughly 20 grams of silver. Hundreds of gigawatts now under construction are adding another powerful layer of demand.

5) EVs Are Full Steam Ahead Globally

Global EV sales reached 17 million in 2024 and are tracking above 20 million in 2025. Each battery-electric vehicle uses 25–50 grams of silver across inverters, chargers, relays, and sensors — nearly 90 million ounces per year in total.

6) Silver Is Cheap

With gold near $4,400 and silver around $75, the gold-to-silver ratio sits near 58:1. In 1980, it hit 15:1. Even a partial move back toward the historical average could mean a multi-fold rise in silver’s price — even if gold stays flat.

7) Smart Money and Momentum

Silver is up about 140% since last year, outrunning gold, copper, and palladium. Institutional and sovereign investors are stepping in — signaling that the cycle is turning.

Management: Leading The Way

Success comes down to people. Core Silver’s leadership blends discovery, operations, and capital markets. They know how to find ounces, finance the work, and advance assets.

Nicholas Rodway, P.Geo., CEO, President, Director

Nicholas Rodway is a geologist and company builder with a decade of public-markets experience across deals, projects, and investor relations. He founded Exploits Gold Corp., which was acquired by Exploits Discovery Corp. and later had it’s projects sold to New Found Gold Corp

Monica Barrington, B.Sc., VP Exploration

Monica Barrington is an Atlin-based exploration geologist with nine years of field and research experience in Eastern Canada, the Golden Triangle, and the Atlin Mining Camp.

Joshua Vann, BCom (Finance), VP Business Development

Before joining the Core Silver team, Joshua previously worked in Equity Research at PI Financial Corp. on the Special Situations Team. He has extensive experience working in corporate development for publicly and privately listed companies in the natural resource sector.

Sean Charland, Director

Sean Charland brings more than 15 years in capital markets and resource exploration, focused on financing, M&A, growth marketing, and team leadership. He served as a director of Alpha Lithium, which was acquired for more than $300 million.

Conclusion: The Great Silver Surge Is Now

Silver is headed into a perfect storm. Demand is coming from all sides – both industrial and monetary.

Data centers, EVs, RFID, Military, Solar, and electronics are driving consumption to new highs.

At the same time, silver’s monetary role is attracting billions in global investment.

But supply isn’t moving at all. Production has been flat for years — and it’s now colliding with record demand. A record supply gap is projected for 2026, with more to follow in the years ahead.

The market is already reacting. Silver has surged to all time highs, outpacing gold, copper, and nearly every other major metal.

And yet… the potential upside remains enormous.

The gold-to-silver ratio sits at an extreme. Even a modest reversion could ignite another massive run.

Historically, when silver tightens, junior exploration and development companies with large, high-potential projects move first — and fastest.

That’s exactly where Core Silver Corp. (CSE: CC | OTC: CCOOF) sits.

District-scale geology. Multiple targets. Fresh capital. Active drills testing the thickest, most promising parts of the system.

The story is simple: persistent demand, structural shortage, and historic mispricing.

Now is the time to take a close look at Core Silver Corp. (CSE: CC | OTC: CCOOF) as it ramps up its silver stake in mining-friendly, geopolitically stable Canada.

GENERAL NOTICE AND DISCLAIMER – PLEASE READ CAREFULLY THE FOLLOWING NOTICE AND DISCLAIMER MUST BE READ AND UNDERSTOOD AND YOU MUST AGREE TO THE TERMS CONTAINED THEREIN BEFORE USING THIS WEBSITE OR SUBSCRIBING TO OUR NEWSLETTER. We are engaged in the business of advertising and promoting companies. All content on our website is for informational purposes only and should not be construed as an offer or solicitation of an offer to buy or sell securities. Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a solicitation of the purchase or sale of any securities. Neither the owner of wallstpicks.com nor any of its members, officers, directors, contractors or employees are licensed broker-dealers, account representatives, market makers, investment bankers, investment advisors, analyst or underwriters. Investing in securities, including the securities of those companies profiled or discussed on this website is for individuals tolerant of high risks. Viewers should always consult with a licensed securities professional before purchasing or selling any securities of companies profiled or discussed on wallstpicks.com. It is possible that a viewer’s entire investment may be lost or impaired due to the speculative nature of the companies profiled. Remember, never invest in any security of a company profiled or discussed on this website unless you can afford to lose your entire investment. Also, investing in micro-cap securities is highly speculative and carries an extremely high degree of risk. wallstpicks.com makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website. wallstpicks.com has been retained by an unrelated third party to perform promotional and advertising services for a limited time with respect to the company we are profiling or discussing on this website and in exchange for such services has received cash compensation from such third party.

Mineral exploration and development are highly speculative and are characterized by a number of significant inherent risks, which may result in the inability to successfully develop projects for commercial, technical, political, regulatory or financial reasons, or if successfully developed, may not remain economically viable for their mine life owing to any of the foregoing reasons. There is no assurance that Core Silver Corp. will be successful in achieving a return on shareholders’ investment and the likelihood of success must be considered in light of the [early] stage of operations.

Core Silvers ability to identify Mineral Resources in sufficient quantity and quality to justify development activities and/or its ability to commence and complete development work and/or commence and/or sustain commercial production operations at any of its projects will depend upon numerous factors, many of which are beyond its control, including exploration success, the obtaining of funding for all phases of exploration, development and commercial mining, the adequacy of infrastructure, geological characteristics, metallurgical characteristics of any deposit, the availability of processing technology and capacity, the availability of storage capacity, the supply of and demand for silver and other minerals, the availability of equipment and facilities necessary to commence and complete development, the cost of consumables and mining and processing equipment, technological and engineering problems, accidents or acts of sabotage or terrorism, civil unrest and protests, currency fluctuations, changes in regulations, the availability of water, the availability and productivity of skilled labour, the receipt of necessary consents, permits and licenses (including mining licenses), and political factors, including unexpected changes in governments or governmental policies towards exploration, development and commercial mining activities.

Furthermore, cost over-runs or unexpected changes in commodity prices in any future development could make the projects uneconomic, even if previously determined to be economic under feasibility studies. Accordingly, notwithstanding the positive results of one or more feasibility studies on the projects, there is a risk that Core Silver Corp. would be unable to complete development and commence commercial mining operations at one or more of the mineral properties which would have a material adverse effect on its business, financial condition, results of operations and prospects.

For a more comprehensive overview of the risks related to Core Silver’s business, please review Core Silver’s continuous disclosure documents, each filed under the Company’s profile at www.sedarplus.ca.

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Upswitch Media Corp. and its owners, managers, employees, and assigns (collectively “Upswitch Media Corp”) has been paid for Core Silver Corp. (the “Company”) One Million Canadian dollars (CAD$1,000,000) plus applicable taxes for an ongoing marketing campaign and is including this article, among other things. This compensation is a major conflict with our ability to be unbiased. This communication is for entertainment purposes only. Never invest purely based on our communication.

SHARE OWNERSHIP. The owner of Upswitch Media Corp. may be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities. This relationship and the compensation to be received by us is a major conflict with our ability to be unbiased.

Questions regarding this website may be sent to info@wallstpicks.com. Some of the content on this website contains forward-looking information within the meaning of Section 27A of the Securities Act of 1993 and Section 21E of the Securities Exchange Act of 1934 including statements regarding expected continual growth of a company and the value of its securities. In accordance with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 it is hereby noted that statements contained herein that look forward in time which include everything other than historical information, involve risk and uncertainties that may affect a company’s actual results of operation. A company’s actual performance could greatly differ from those described in any forward looking statements or announcements mentioned on this website or the websites contained within. Factors that should be considered that could cause actual results to differ include: the size and growth of the market for the company’s products; the company’s ability to fund its capital requirements in the near term and in the long term; pricing pressures; unforeseen and/or unexpected circumstances in happenings; etc. and the risk factors and other factors set forth in the company’s filings with the Securities and Exchange Commission. However, a company’s past performance does not guarantee future results. Generally, the information regarding a company profiled or discussed on this website is provided from public sources. wallstpicks.com makes no representations, warranties or guarantees as to the accuracy or completeness of the information provided or discussed. Viewers should not rely solely on the information obtained through our website or in communications originating from our website. Viewers should use the information provided by us regarding the profiled companies as a starting point for additional independent research on the companies profiled or discussed in order to allow the viewer to form his or her own opinion regarding investing in the securities of such companies. Factual statements, or the similar, made by the profiled companies are made as of the date stated and are subject to change without notice and wallstpicks.com has no obligation to update any of the information provided. Wallstpicks.com, its owners, officers, directors, contractors and employees are not responsible for errors and omissions. From time to time certain content on this website is written and published by our employees or third parties. In addition to information about our profiled companies, from time to time, our website will contain the symbols of companies and/or news feeds about companies that are not being profiled by us but are merely illustrative of certain activity in the micro cap or penny stock market that we are highlighting. Viewers are advised that all analysis reports and news feeds are issued solely for informational purposes. Any opinions expressed are subject to change without notice. It is also possible that one or more of the companies discussed or profiled on this website may not have approved certain or any statements within the website. Wallstpicks.com encourages viewers to supplement the information obtained from this website with independent research and other professional advice. The content on this website is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Third Party Web Sites and Other Information This website may provide hyperlinks to third party websites or access to third party content.

wallstpicks.com, its owners, officers, directors, contractors and employees are not responsible for errors and omissions nor does wallstpicks.com control, endorse, or guarantee any content found in such sites. wallstpicks.com does not control, endorse, or guarantee content found in such sites. By accessing, viewing, or using the website or communications originating from the website, you agree that wallstpicks.com, its owners, officers, directors, contractors and employees, are not responsible for any content, associated links, resources, or services associated with a third party website. You further agree that wallstpicks.com, its owners, officers, directors, contractors and employees shall not be liable for any loss or damage of any sort associated with your use of third party content. Links and access to these sites are provided for your convenience only. Wallstpicks.com uses third parties to disseminate information to subscribers.

Wallstpicks.com also places cookies on your computer to allow third party ads to retarget your IP address. Although we take precautions to prevent others from obtaining our subscriber list, there is a risk that our subscriber list, through no wrong doing on our part, could end up in the hands of an unauthorized party and that subscribers will receive communications from unauthorized third parties. We encourage viewers to invest carefully and read the investor issuer information available at the web sites of the United States Securities and Exchange Commission (SEC). The SEC has launched an investor-focused website to help you invest wisely and avoid fraud at www.investor.gov and filings made by public companies can be viewed at www.sec.gov and/or the Financial Industry Regulatory Authority (FINRA) at: www.finra.org. In addition, FINRA has published information at its website on how to invest carefully at www.finra.org/Investors/index.htm. Income Disclaimer: Testimonials and examples used here are exceptional results which may not apply to the average purchaser. They are not intended to represent or guarantee that anyone will achieve the same or similar results through our service. The use of our information should be based on your own due diligence, and you agree that our company is not liable for any success or failure of your business that is directly or indirectly related to the use of our information. As with any business, your results may vary, and will be based on your individual capacity, business experience and expertise. There are no guarantees concerning the level of success you may experience. Income statements made by our customers are only estimates of what they have earned; there is no guarantee that you will make these levels of income. When using our information, you accept the risk that these earnings and income statements differ by individual. There is no assurance that examples of past earnings can be duplicated in the future. There are unknown risks in business and on the internet that we cannot anticipate which can reduce results. We therefore cannot guarantee your future results or success, and are not responsible for your actions.

Reference

- 1. https://www.usgs.gov/news/science-snippet/department-interior-releases-draft-2025-list-critical-minerals

-

2. https://markets.financialcontent.com/stocks/

article/marketminute-2026-1-6-silver-surges-265-as-technical-breakout-targets-101-market-eyes-multi-decade-highs#google_vignette - 3. https://bullionexchanges.com/blog/silver-s-role-in-the-ai-and-ev-boom

-

4. https://pubs.usgs.gov/periodicals/mcs2022

/mcs2022-silver.pdf#:~:text=Domestic%20Production%

20and%20Use:%20In%202021%2C%20U.S.,

from%2033%20domestic%20base%2D%20

and%20precious%2Dmetal%20operations. - 5. http://goldmarket.fr/en/the-strategic-role-of-silver-in-defense-and-aeronautics/

- 6. https://www.jpost.com/business-and-innovation/precious-metals/article-824693

- 7. https://www.cruxinvestor.com/posts/silvers-structural-supply-crisis-creates-exceptional-investment-opportunities-in-mining-sector

-

8. https://tradingeconomics.com/commodity/

silver - 9. https://www.kitco.com/news/article/2025-07-10/silver-investment-ramps-2025-etf-inflows-already-surpass-all-2024-silver

- 10. https://tampasteel.com/best-metals-conduct-electricity/

- 11. https://www.mining.com/web/column-us-critical-minerals-list-expands-ahead-of-possible-tariffs/

- 12. https://www.jpost.com/business-and-innovation/precious-metals/article-824693

- 13. https://www.americanhartfordgold.com/silver-set-for-major-surge/

- 14. https://www.americanhartfordgold.com/silver-set-for-major-surge/

- 15. https://sprott.com/insights/silver-investment-outlook-mid-year-2025/

- 16. https://english.elpais.com/economy-and-business/2025-08-05/apple-falls-back-on-the-iphone-3-billion-sold-since-2007-and-200-billion-in-annual-revenue.html

- 17. https://investingnews.com/daily/resource-investing/precious-metals-investing/silver-investing/silver-in-the-future/

- 18. https://www.rfidjournal.com/news/report-115-billion-uhf-rain-rfid-tag-chips-ahead/215540/

- 19. https://english.elpais.com/economy-and-business/2025-08-05/apple-falls-back-on-the-iphone-3-billion-sold-since-2007-and-200-billion-in-annual-revenue.html

- 20. https://silverinstitute.org/silver-demand-printed-flexible-electronics-forecast-consume-615-million-ounces-silver-2030/

- 21. https://www.eia.gov/todayinenergy/detail.php?id=65064

- 22. ttps://werecyclesolar.com/how-much-silver-is-used-in-solar-panels/

- 23. https://www.cruxinvestor.com/posts/silver-sneak-peaks-from-early-production-reports-for-q1-2025

- 24. https://sprott.com/insights/silver-s-critical-role-in-the-clean-energy-transition/

- 25. https://learn.apmex.com/learning-guide/science/silver-and-green-technology/

- 26. https://www.macrotrends.net/1441/gold-to-silver-ratio

- 27. https://www.cmegroup.com/insights/economic-research/2025/four-major-drivers-of-the-gold-silver-price-ratio.html

- 28. https://www.cruxinvestor.com/posts/silvers-structural-bull-market-investment-opportunities-in-a-supply-constrained-market

- 29. https://www.juniorminingnetwork.com/junior-miner-news/press-releases/2850-cse/cc/185177-core-silver-rebrands-announces-4-5m-life-flow-through-offering.html

- 30. https://coreassetscorp.com/projects/blue-property/

- 31. https://coresilvercorp.com/projects/