The Hidden Opportunity Tech Giants are Chasing – And it’s Not What You Think

Report: Early-stage company racing down the same path as the last monster breakout—before it delivered a staggering 23,580% return.

While most investors chase the latest AI trend…The world’s billionaire insiders are going deeper—to the essential tech that powers the whole revolution.

A small group of tech titans have already made strategic moves into this overlooked but critical piece of the AI supply chain — and when billionaires pile in this early, it’s never by accident.

Former Goldman Sachs strategist, Jeff Currie has called it, “The most compelling trade I’ve seen in 30+ years.”1

This isn’t about software, chips, or the latest AI app. It’s about the metal driving the entire technological revolution— and it’s about to break out to historic highs.

One tiny company backed by some of the world’s leading billionaires rode this same setup to a jaw-dropping 23,580% gain in just six years.

Now, a new name is following a remarkably familiar playbook.

It’s called Star Copper Corp. (OTC:STCUF | CSE:STCU)—a high-potential explorer targeting one of the most copper-rich regions on Earth.

But here’s what makes this story different: the team behind Star Copper has done it before.

They were the driving force behind Alpha Lithium, where they took a $20 million grassroots asset, raised over $100 million, built out a significant resource, and sold the company in a $313 million all-cash acquisition—all in just over three years. That wasn’t a fluke. It was a masterclass in building value from the ground up.

Now they’re bringing that same strategy to copper.

Star Copper’s flagship project has already proven itself with historical drill results showing open mineralization in every direction. But the real excitement is happening now. A successful, ongoing drilling program is hitting targets and expanding the system with every round—building the case that this could be one of the next great porphyry copper discoveries. Each new hole confirms what early results suggested: this deposit has size, strength, and serious upside.

The timing couldn’t be better. Copper is setting up exactly the way it has at the start of every major bull market in history—exploding demand, tight supply, and early movers poised for massive gains. Star Copper is right at the center of that setup. With a seasoned team, a proven exploration model, and a world-class asset that keeps delivering results, the company is positioning itself as the next breakout winner of the copper supercycle.

Copper Crunch Begins: Supply Drops as Global Demand Breaks Record

Copper is experiencing a historic breakout.

A typically steady market, copper has hit all-time highs in 2025…and is now on track to shatter new records in 2026.2

Robert Friedland, a billionaire mining legend warns, “The world is suffering from a shortage of copper metal. Humanity would have to mine more copper in the next 20 years than we have in human history to meet surging global demand.”3

That’s thousands of years of demand crammed into just a couple of decades.

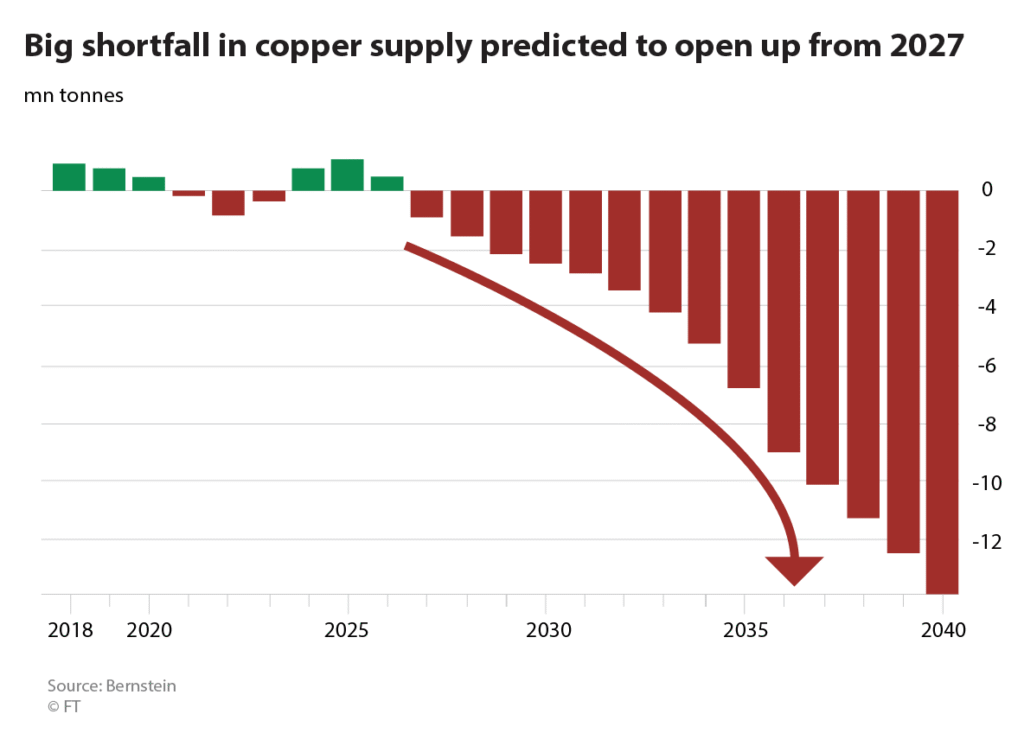

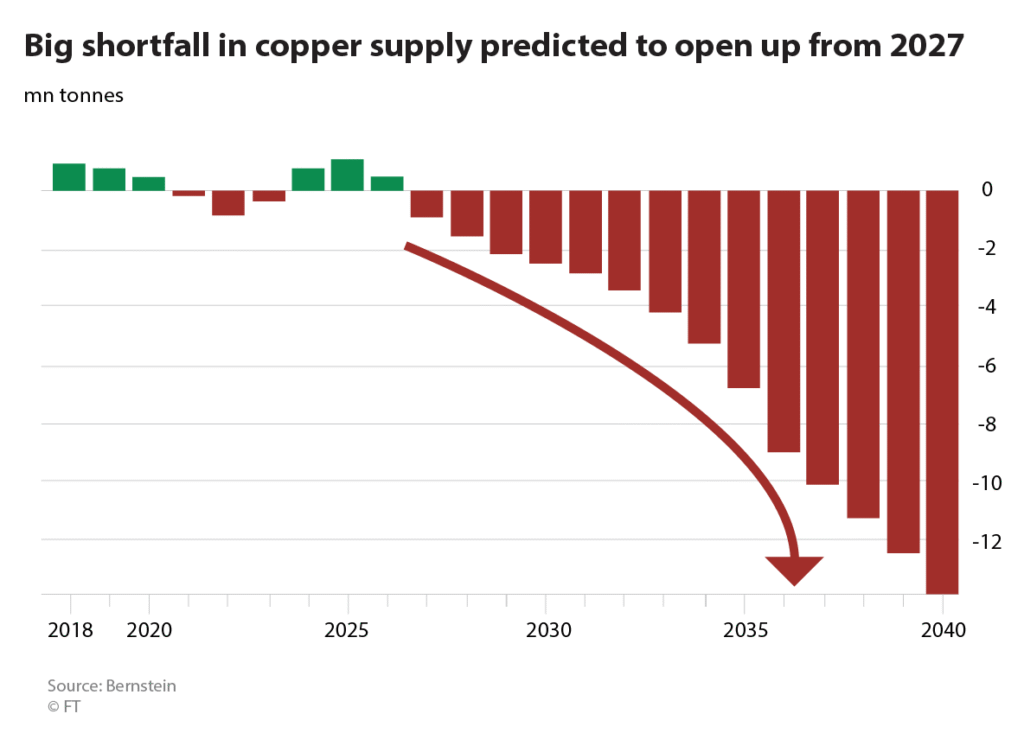

This chart shows how this surging demand is set to create a massive shortage:4

The supply-demand gap for copper is barely holding steady today — but that’s about to change. A structural supply deficit is looming, and every year from now, the shortfall is expected to widen.

What feels like “lean years” today, with copper prices already hitting all-time highs could soon be remembered as the good times.

And it could get even worse because of AI.

Copper already has a strong foundation of demand growth, driven by the accelerating global electrification megatrend. And every aspect needs more copper.

EV’s require 4x more copper than gas-powered vehicles. Wind turbines, solar panels, and battery storage rely on massive amounts of copper. The power grid needs a complete overhaul, requiring millions of tons of copper to support the transition to renewable energy.

But now, AI infrastructure is emerging as the game-changer in copper demand.

“Today, data centers are less than 1 per cent of copper demand, but that is expected to be 6 to 7 per cent by 2050. There is a lot of copper in data centers.”5

– Vandita Pant, CFO of BHP –to The Financial Times

That’s an entirely new layer of demand—stacked on top of an already-tight market.

Considering that, it’s no surprise that billionaire investor CEO’s from Amazon, Virgin, Microsoft and Alibaba Group have already positioned themselves in the copper boom.

And its why companies like Star Copper (OTC:STCUF | CSE:STCU) are attracting major attention right now.

2025 Is A “Tipping Point” Year For Copper

Copper is a commodity. Like all commodities, its price is mostly driven by supply and demand. But the current copper situation is different than most commodity booms.

It’s being squeezed from both sides.

Demand is accelerating at record speed, and supply isn’t just struggling to keep up, it’s falling even further behind.

We’ll break both down below, but here’s the bottom line from billionaire mining legend Robert Friedland.

He said, “We see a crisis coming in physical markets and a requirement for much higher prices to enable most of the copper projects that are in development to have a prayer coming in.”7

Translation?

We’re heading straight for a major copper shortage—and prices may have to surge to fix it.

That’s why companies like Star Copper (OTC:STCUF | CSE:STCU) are looking to fill the looming supply gap. And as this setup unfolds, the opportunity for early investors is becoming increasingly clear.

This chart shows exactly why the copper market is at a breaking point:7

You can see “primary demand” rising steadily. But the “probable projects” that would provide the vital new supply are falling fast.

Eventually, even just “possible projects” won’t be enough.

The result is extreme.

And it’s why we’re going to look at this chart again.

The supply and demand chart above results in growing supply shortages like this chart shows.8

This is where it gets serious.

This chart shows we’re not just looking at a “tight” market. Instead, we’re staring down a massive supply gap.

It’s manageable for now… but that’s not expected to last. Modest shortages grow and eventually they become extreme.

A recent McKinsey study found that the global copper shortage could reach 6.5 million tonnes in the near future.9

To put that into perspective, consider Escondida, the world’s largest copper mine in Chile.

It’s enormous. Its mine pits are 20 square kilometers wide. That’s like 43,000 football fields.10 It produces $33 million worth of copper every single day.11

To meet the projected shortage, the world would need at least five new Escondida-scale mines to begin production within the next five years.

That’s not happening. Not even one mine of that scale is expected to come online by 2030 – let alone six.

And there’s not much hope for ever getting a mine that big again because new copper discoveries are rarer than they’ve been in decades.12

And that’s why Star Copper (OTC:STCUF | CSE:STCU) is pushing ahead aggressively in one of the world’s richest copper regions.

Because the world isn’t ready for what’s coming. And smart investors are getting in before the real squeeze begins.

Copper’s Double-Whammy Supply Crisis

Copper isn’t just dealing with exploding demand – the supply side is collapsing too. Not only is production tight, but new discoveries are drying up.

And it’s why companies like Star Copper (OTC:STCUF | CSE:STCU) are racing to secure the next big find right now.

We’re finding fewer deposits, the ones we do find are getting smaller and they’re often lower grade then ever before.

That’s a brutal combination and it’s exactly why smart money is piling into copper plays before the squeeze hits full force. And it’s going to take a lot of smart money to fix the problem.

BloombergNEF’s Transition Metals Outlook 2024 estimates that reaching global net-zero goals will require $2.1 trillion in investment – roughly $84 billion a year.

But here’s the kicker…

Mining companies aren’t spending anywhere near enough.

Capital expenditures for copper mining plummeted to just $14.4 billion in 2022 – down more than 50% from $26.1 billion in 2013.

So we’ve got skyrocketing demand…A broken discovery pipeline…And not enough investment into the system.

That’s a very compelling case for companies like Star Copper (OTC:STCUF | CSE:STCU) which are targeting new copper discoveries.

But we haven’t even mentioned the one thing that could make this crisis even worse…

AI Straw Breaks The Camel’s Copper Back

Copper prices are climbing — and hovering near all-time highs.

But this isn’t your usual supply-and-demand story. The delicate balance that’s kept copper in check for years is breaking apart.

Its because of Data centers. And they’re about to rewrite the rulebook for copper demand.

According to researchers at global consulting giant McKinsey & Company, the number of data centers is set to triple by the end of the decade.13

And with that growth comes an energy appetite unlike anything we’ve seen.

They’re projecting annual electricity demand between 171 and 219 gigawatts of electricity.14 That’s the equivalent of 20 New York Cities running at full capacity in the middle of summer.15

And every single watt needs copper. From the power grid to the racks of processors, copper is the lifeblood of this digital infrastructure.

Copper was in a tight spot before the AI and data center frenzy launched. Now the market is breaking wide open.

And companies like Star Copper (OTC:STCUF | CSE:STCU) are rolling out plans to seize the opportunity.

Because copper stocks are growing exponentially.

The Copper Boom Is Already Paying Off Big

The copper boom is happening right now and investors are already making huge profits.

Star Copper (OTC:STCUF | CSE:STCU) is a relatively early-stage copper exploration company. But it’s following a proven path that’s already created billion-dollar wins in this sector.

One of the most exciting copper stories in the world is KoBold Metals. It might be the best investment of the last five years.

In 2019, KoBold started with just $5 million in funding and with a valuation of $12.5 million.16 By the end of 2024, it had raised $500 million and reached a $2.96 billion valuation.

That makes KoBold’s total increase at 23,580%17 in six years. It’s like a stock going from $1 to $236… in six years

It’s an eye-popping move, fueled entirely by copper.

Using artificial intelligence, KoBold takes old mining data and turns it into new discoveries.

And it’s working. The company’s rising value speaks for itself.

It is backed by legendary tech pioneers and Andreesen Horowitz, one of silicon valleys most respected VC firms but even with strong support from tech leaders and mining giants, the copper shortage is far from over.

And KoBold isn’t the only success story.

Filo Mining is another copper play making early investors rich.

Located in the Andes Mountains on the Chile-Argentina border, Filo’s stock traded around C$2.00 before its major copper discovery.

Within five years, it was bought out for C$32.50 per share—a gain of over 1,500%.

That buyout was worth more than C$4 billion. But that’s not all.

NGEX Resources is another big name in copper. In 2020, its shares traded between C$0.50 and C$1.00.

Then it confirmed a major copper discovery—also in the Andes Mountains in Argentina.

Since then, its stock has kept climbing year after year. By 2025, NGEX shares were trading above C$13—a gain of more than 2,400% since 2020.

These are porphyry copper discoveries—and they’re creating massive value.

And there’s another major win: Skeena Resources has made a big multi-metallic discovery in the Golden Triangle.

That’s the same region Star Copper is exploring in.

Just a year ago, you could’ve bought Skeena shares for under C$5.00. By 2025, they were trading above C$16 which is more than a 3x gain.

The copper boom is real. And it’s just getting started.

And it’s why Star Copper (OTC: STCUF | CSE: STCU) is advancing aggressively right now—drilling, expanding, and building on every new result.

6 Reasons Star Copper (OTC:STCUF | CSE:STCU)Could Be the Next Big Copper Breakout

Copper Demand Is Surging Like Never Before

Copper is fueling the 21st century—powering electric vehicles, AI chips, smart grids, and next-gen data centers. McKinsey projects data center electricity demand will triple by 2030, pushing copper consumption to all-time highs. With global electrification on fast-forward, the world now needs more copper than it has ever mined in history—making this one of the most urgent and investable megatrends of the decade.

A Supply Crisis No One Is Prepared For

While demand explodes, supply is falling off a cliff. New copper discoveries are declining, major mines are depleting, and mining investment has dropped by over 45% in just 10 years. Worse, it now takes nearly 16 years to bring a new mine online. The result? A growing supply gap—and a powerful price surge setup that savvy investors won’t want to miss.

Billionaire Investors Are Already In

CEO’s from Amazon, Virgin, Microsoft and Alibaba Group. They’ve already placed major bets on copper. KoBold Metals, a startup backed by Andreessen Horowitz, ballooned from $12.5M to nearly $3B in just six years by using AI to discover new copper deposits. When billionaires move this early, it’s a signal—the smart money is already circling.

Star Copper’s Project Is in a World-Class Region

Located in British Columbia’s legendary Golden Triangle, Star Copper’s flagship project sits in a proven district known for massive copper and gold discoveries. The region has produced multi-billion-dollar projects like Newcrest’s $3.5B Brucejack mine and was responsible for Skeena Resources’ meteoric rise. Star Copper is surrounded by big success—and they’re drilling in the heart of it.

Massive Upside Potential from a Known Discovery

Back in 2014, a drill hole at the Star Project cut into strong copper mineralization at 660 meters—but the program was halted due to budget constraints, not geology. The system remained open at depth and in every direction. Today, Star Copper is back on the ground with modern technology, an active drill program, and the funding to finally test the scale of this porphyry system. Early results are confirming the strength of the mineralization, and with a market valuation still far below nearby discoveries, the setup has all the hallmarks of a ground-floor opportunity.

Copper Stocks Are Already Exploding

Early investors in copper are already seeing life-changing gains:

• KoBold Metals: +38,093% in 5 years

• Filo Mining: +1,500%

• NGEx Resources: +2,400% since 2020

The copper squeeze is real. And as it deepens, junior explorers like Star Copper could be next in line for breakout growth.

“Golden Triangle” Producing World-Class Copper Discoveries

Star Copper’s flagship project is located in Canada, a country known for its rich mineral resources, political stability, and strong support for mining.

More specifically, the project sits in British Columbia’s historic Golden Triangle, one of the most prolific mining regions in western Canada.

As shown on the map below, the Star Project is surrounded by major mineral discoveries and lies just near the Alaska border.

The reason this region hosts so many major mineral discoveries is because of the presence of a special type of deposit known as a porphyry.18

Porphyry deposits aren’t just common in certain parts of the world, they can be incredibly valuable.

And its why companies like Star Copper (OTC:STCUF | CSE:STCU) which are targeting them attract so much interest.

But back to porphyry deposits.

They form when hot magma pushes copper-rich fluids up through the earth. When it cools, it leaves behind a huge body of copper-rich rock.

Here’s what that looks like in a typical porphyry system:19

That’s why big-name mining companies have been spending billions in this region:

– Newcrest Mining paid $3.5 billion to acquire the Brucejack mine (right in the neighborhood).

– Skeena Resources, which owns the Eskay Creek project, saw its shares triple in the past year based mostly on plans to build a mine by 2027. That’s pushed the company’s value past $1 billion.

-Newcrest also paid $804 million for a 70% stake in the Red Chris copper mine back in 2019. That valued the entire mine at over $1 billion—when copper prices were 40% lower than they are today.

And then there’s Galore Creek—one of the biggest undeveloped copper projects in North America. It holds over 12 billion pounds of copper.

One of the companies behind it, NOVAGOLD, owns half of it, and that alone gives the company a market cap of over US$1.1 billion.

All of these are porphyry copper projects. And they’re all in the Golden Triangle.

Now, let’s come back to Star Copper (OTC:STCUF | CSE:STCU).

Unlike the massive discoveries already made in the region, Star Copper is still in the early stages and working to prove up its own find and carve out a place among those multi-billion-dollar success stories.

What sets Star Copper apart? It sits right in the heart of this high-grade, high-potential region.

And it’s happening right now. Star Copper has boots on the ground, drills turning, and a clear plan to accelerate exploration. With every new hole, the company is working to unlock the full value of its project—and the market is only just beginning to catch on.

How Star Copper’s Targeting Next “Golden Triangle” Game-Changer Success

Star Copper’s Star Project sits in the middle of one of the most copper-rich regions in the world.

It’s surrounded by massive porphyry systems. And here’s the thing about porphyries. When you find one, there are usually more nearby.

That’s because these deposits often form in geological belts—like the ones running through Peru, Chile, and Argentina along the Andes.

They’re shaped by deep faults and ancient volcanic activity.

British Columbia’s Stikine Arch is one of those belts. It’s a proven zone for porphyry copper discoveries.20

The Star Project was last drilled back in 2014, when it was owned by two companies in a 51/49 partnership.

But it was a tough time for copper back then.

And the challenges for copper development then play a major role in the current copper supply situation.

That fact, combined with the project’s location, copper market, and every other tailwind, is why Star Copper acquired the project.

It’s more advanced, which means the company can move faster to help close the widening supply gap.

The Star Project already has a small fortune’s worth of work behind it, thanks to the previous owners.

They drilled nearly 50 holes, totaling 16,000 meters in the ground. That’s a lot of work, time, and money.

At today’s rate of $500 per meter, that drilling alone would cost over $8 million. It’s a major head start and it’s not even the best part.

The last operators didn’t stop because they ran out of mineralization. Their final hole went down 660 meters and was still hitting copper.

That means the deposit is still open at depth, in addition to being open in every direction.

It’s the kind of setup explorers dream about.

Star Copper didn’t just acquire a greenfield project in hopes of hitting another major porphyry in this land of giant porphyry discoveries, they acquired all the historical data and findings that came with it.

Now Star Copper is picking up right where the drills left off, with an aggressive exploration program designed to unlock even more value.

The latest results are especially exciting: assays have confirmed a Supergene zone, but on a larger scale, the company believes the oxide zone at surface may hold even greater potential.

New geological modelling shows mineralization is consistent down to 200 meters and deeper—while the presence of a much larger oxide cap delivers near-surface copper that instantly adds value, something rarely seen at the exploration stage (more typical of producing mines).

Even more compelling, the oxide zone remains open to the northeast and southwest, suggesting significant room for expansion.

If this growth is confirmed, it could quickly elevate the project’s profile and draw the attention of major copper companies seeking new large-scale assets.

With systematic soil sampling, reconfirmation drilling, and deep drilling already underway, every step is building momentum toward proving out what could be a world-class porphyry copper system.

Star Copper (OTC:STCUF | CSE:STCU) is now pushing forward with the right plan, in the right location, at the right time.

Leading the way

Here’s the team that’s making it happen.

BRAD NICHOL, BOARD CHAIRMAN

For over 25 years, Mr. Nichol has held senior executive and director roles in public and private companies across the global finance and resource sectors. As CEO of Alpha Lithium, he transformed a $20 million grassroots project into a $313 million all-cash acquisition in just over three years, raising over $100 million and building a significant resource. He has led numerous organizations through private and public financings, dual listings in North America and Europe, key asset acquisitions, and the development of strong financial and operational partnerships worldwide.

DARRYL JONES, PRESIDENT & CEO

15+ years of capital market experience and an established financial network. He was a founding Director at Alpha Lithium which sold for approx. $320 million (Dec 2023).

BILL MORTON M.SC., P.GEO. DIRECTOR, TECHNICAL LEAD

Driving force in the acquiring and optioning Sun Metal’s Stardust Project Senior management of public resource companies for 20 years and is or has been a Director or Technical Advisor to more than a dozen public resource companies. Professional Geologist since 1991 and is a Member in good standing of Engineers and Geoscientists, British Columbia.

Winning The Copper End Game

The global race to secure copper is no longer just about mining—it’s about meeting the core demand of the next industrial age.

From AI and EVs to data centers and global grid upgrades, copper is the critical metal behind every major technological shift of the 21st century.

But supply isn’t keeping up.

Industry experts, mining legends, and institutional giants all agree that we’re heading into a copper crisis that could reshape global markets.

As the world scrambles to find new high-grade deposits, companies like Star Copper (OTC:STCUF | CSE:STCU) are stepping into the spotlight.

With a prime project in British Columbia’s legendary Golden Triangle, a proven porphyry system, and a leadership team that’s already delivered $320 million exits, Star Copper is positioned at the heart of this generational opportunity.

The copper squeeze isn’t coming. It’s already here.

And junior mining companies like Star Copper that are targeting high grade copper discoveries could be a key player in solving the global shortage.

This is the time to investigate Star Copper (OTC:STCUF | CSE:STCU) as it ramps up its copper stake in mining-friendly, geopolitically stable Canada.

GENERAL NOTICE AND DISCLAIMER – PLEASE READ CAREFULLY THE FOLLOWING NOTICE AND DISCLAIMER MUST BE READ AND UNDERSTOOD AND YOU MUST AGREE TO THE TERMS CONTAINED THEREIN BEFORE USING THIS WEBSITE OR SUBSCRIBING TO OUR NEWSLETTER. We are engaged in the business of advertising and promoting companies. All content on our website is for informational purposes only and should not be construed as an offer or solicitation of an offer to buy or sell securities. Neither the information presented nor any statement or expression of opinion, or any other matter herein, directly or indirectly constitutes a solicitation of the purchase or sale of any securities. Neither the owner of www.wallstpicks.com nor any of its members, officers, directors, contractors or employees are licensed broker-dealers, account representatives, market makers, investment bankers, investment advisors, analyst or underwriters. Investing in securities, including the securities of those companies profiled or discussed on this website is for individuals tolerant of high risks. Viewers should always consult with a licensed securities professional before purchasing or selling any securities of companies profiled or discussed on wallstpicks.com. It is possible that a viewer’s entire investment may be lost or impaired due to the speculative nature of the companies profiled. Remember, never invest in any security of a company profiled or discussed on this website unless you can afford to lose your entire investment. Also, investing in micro-cap securities is highly speculative and carries an extremely high degree of risk. wallstpicks.com makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website wallstpicks.com has been retained by an unrelated third party to perform promotional and advertising services for a limited time with respect to the company we are profiling or discussing on this website and in exchange for such services has received cash compensation from such third party.

Mineral exploration and development are highly speculative and are characterized by a number of significant inherent risks, which may result in the inability to successfully develop projects for commercial, technical, political, regulatory or financial reasons, or if successfully developed, may not remain economically viable for their mine life owing to any of the foregoing reasons. There is no assurance that Star Copper Corp. will be successful in achieving a return on shareholders’ investment and the likelihood of success must be considered in light of the [early] stage of operations.

Star Coppers ability to identify Mineral Resources in sufficient quantity and quality to justify development activities and/or its ability to commence and complete development work and/or commence and/or sustain commercial production operations at any of its projects will depend upon numerous factors, many of which are beyond its control, including exploration success, the obtaining of funding for all phases of exploration, development and commercial mining, the adequacy of infrastructure, geological characteristics, metallurgical characteristics of any deposit, the availability of processing technology and capacity, the availability of storage capacity, the supply of and demand for gold and other minerals, the availability of equipment and facilities necessary to commence and complete development, the cost of consumables and mining and processing equipment, technological and engineering problems, accidents or acts of sabotage or terrorism, civil unrest and protests, currency fluctuations, changes in regulations, the availability of water, the availability and productivity of skilled labour, the receipt of necessary consents, permits and licenses (including mining licenses), and political factors, including unexpected changes in governments or governmental policies towards exploration, development and commercial mining activities.

Furthermore, cost over-runs or unexpected changes in commodity prices in any future development could make the projects uneconomic, even if previously determined to be economic under feasibility studies. Accordingly, notwithstanding the positive results of one or more feasibility studies on the projects, there is a risk that Star Copper Corp. would be unable to complete development and commence commercial mining operations at one or more of the mineral properties which would have a material adverse effect its business, financial condition, results of operations and prospects.

For a more comprehensive overview of the risks related to Star Copper’s business, please review Star Copper’s continuous disclosure documents, each filed under the Company’s profile at www.sedarplus.ca.

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Upswitch Media Corp. and its owners, managers, employees, and assigns (collectively “Upswitch Media Corp”) has been paid for Star Copper Corp. (the “Company”) Three Million Eight Hundred and Fifty thousand Canadian dollars (CAD$3,850,000) plus applicable taxes for an ongoing marketing campaign and is including this article, among other things. This compensation is a major conflict with our ability to be unbiased. This communication is for entertainment purposes only. Never invest purely based on our communication.

SHARE OWNERSHIP. The owner of Upswitch Media Corp. may be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities. This relationship and the compensation to be received by us is a major conflict with our ability to be unbiased.

Questions regarding this website may be sent to info@wallstpicks.com. Some of the content on this website contains forward-looking information within the meaning of Section 27A of the Securities Act of 1993 and Section 21E of the Securities Exchange Act of 1934 including statements regarding expected continual growth of a company and the value of its securities. In accordance with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 it is hereby noted that statements contained herein that look forward in time which include everything other than historical information, involve risk and uncertainties that may affect a company’s actual results of operation. A company’s actual performance could greatly differ from those described in any forward looking statements or announcements mentioned on this website or the websites contained within. Factors that should be considered that could cause actual results to differ include: the size and growth of the market for the company’s products; the company’s ability to fund its capital requirements in the near term and in the long term; pricing pressures; unforeseen and/or unexpected circumstances in happenings; etc. and the risk factors and other factors set forth in the company’s filings with the Securities and Exchange Commission. However, a company’s past performance does not guarantee future results. Generally, the information regarding a company profiled or discussed on this website is provided from public sources. Wallstpicks.com makes no representations, warranties or guarantees as to the accuracy or completeness of the information provided or discussed. Viewers should not rely solely on the information obtained through our website or in communications originating from our website. Viewers should use the information provided by us regarding the profiled companies as a starting point for additional independent research on the companies profiled or discussed in order to allow the viewer to form his or her own opinion regarding investing in the securities of such companies. Factual statements, or the similar, made by the profiled companies are made as of the date stated and are subject to change without notice and wallstpicks.com has no obligation to update any of the information provided. Wallstpicks.com, its owners, officers, directors, contractors and employees are not responsible for errors and omissions. From time to time certain content on this website is written and published by our employees or third parties. In addition to information about our profiled companies, from time to time, our website will contain the symbols of companies and/or news feeds about companies that are not being profiled by us but are merely illustrative of certain activity in the micro cap or penny stock market that we are highlighting. Viewers are advised that all analysis reports and news feeds are issued solely for informational purposes. Any opinions expressed are subject to change without notice. It is also possible that one or more of the companies discussed or profiled on this website may not have approved certain or any statements within the website. Wallstpicks.com encourages viewers to supplement the information obtained from this website with independent research and other professional advice. The content on this website is based on sources which we believe to be reliable but is not guaranteed by us as being accurate and does not purport to be a complete statement or summary of the available data. Third Party Web Sites and Other Information This website may provide hyperlinks to third party websites or access to third party content.

Wallstpicks.com, its owners, officers, directors, contractors and employees are not responsible for errors and omissions nor does wallstpicks.com control, endorse, or guarantee any content found in such sites. Wallstpicks.com does not control, endorse, or guarantee content found in such sites. By accessing, viewing, or using the website or communications originating from the website, you agree that Wallstpicks.com, its owners, officers, directors, contractors and employees, are not responsible for any content, associated links, resources, or services associated with a third party website. You further agree that wallstpicks.com, its owners, officers, directors, contractors and employees shall not be liable for any loss or damage of any sort associated with your use of third party content. Links and access to these sites are provided for your convenience only. Wallstpicks.com uses third parties to disseminate information to subscribers.

Wallstpicks.com also places cookies on your computer to allow third party ads to retarget your IP address.. Although we take precautions to prevent others from obtaining our subscriber list, there is a risk that our subscriber list, through no wrong doing on our part, could end up in the hands of an unauthorized party and that subscribers will receive communications from unauthorized third parties. We encourage viewers to invest carefully and read the investor issuer information available at the web sites of the United States Securities and Exchange Commission (SEC). The SEC has launched an investor-focused website to help you invest wisely and avoid fraud at www.investor.gov and filings made by public companies can be viewed at www.sec.gov and/or the Financial Industry Regulatory Authority (FINRA) at: www.finra.org. In addition, FINRA has published information at its website on how to invest carefully at www.finra.org/Investors/index.htm. Income Disclaimer: Testimonials and examples used here are exceptional results which may not apply to the average purchaser. They are not intended to represent or guarantee that anyone will achieve the same or similar results through our service. The use of our information should be based on your own due diligence, and you agree that our company is not liable for any success or failure of your business that is directly or indirectly related to the use of our information. As with any business, your results may vary, and will be based on your individual capacity, business experience and expertise. There are no guarantees concerning the level of success you may experience. Income statements made by our customers are only estimates of what they have earned; there is no guarantee that you will make these levels of income. When using our information, you accept the risk that these earnings and income statements differ by individual. There is no assurance that examples of past earnings can be duplicated in the future. There are unknown risks in business and on the internet that we cannot anticipate which can reduce results. We therefore cannot guarantee your future results or success, and are not responsible for your actions.

References

- 1. https://www.bloomberg.com/news/articles/ 2024-05-17/jeff-currie-says-copper-is-the-best-trade-he-s-seen-in-his-career

- 2. https://tradingeconomics.com/commodity/ copper

- 3. https://www.mining.com/friedland-warns-of-copper-crisis-as-mine-costs-soar/

- 4. https://www.ft.com/content/b3ad2631-f8b9-41df-8e2e-b4493738ded8

- 5. https://www.ft.com/content/da407b47-4133-470a-9574-508cee43e107

- 6. https://www.mining.com/copper-humanitys-first-and-most-important-future-metal/

- 7. https://www.thenetworthclub.com/p/coppers-big-moment-why-this-sleeper

- 8. https://www.ft.com/content/b3ad2631-f8b9-41df-8e2e-b4493738ded8

- 9. https://www.mckinsey.com/industries/metals-and-mining/our-insights/bridging-the-copper-supply-gap

- 10. https://www.mining-technology.com/features/feature-top-ten-deepest-open-pit-mines-world/

- 11. https://plusmining.com/en/2025/02/12/ codelco-managed-to-halt-production-decline- in-2024-but-its-gap-with-escondida-shrinks-to-a -historic-low/#:~:text=In%202024%2C%20E scondida%20increased%20its,was%20around %2010%20percentage%20points

- 12. https://www.spglobal.com/market-intelligence/en/news-insights/research/new-major-copper-discoveries-sparse-amid-shift-away-from-early-stage-exploration

- 13. https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/ai-power-expanding-data-center-capacity-to-meet-growing-demand

- 14. https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/ai-power-expanding-data-center-capacity-to-meet-growing-demand

- 15. https://climate.cityofnewyork.us/subtopics/ systems/

- 16. https://www.yahoo.com/tech/look-energy-companies-bill-gates-090000665.html

- 17. 2.96 billion/12.5 million=236.8

- 18. Star Copper Investor Presentation

- 19. https://earthsci.org/mineral/mindep/phor_dep/por_dep.html

- 20. Star Copper Investor Presentation